EN rebates charges

Preamble

Additionally to pricelists, it is possible in Autopoll to manage rebates and charges, which can be used during the invoicing or when exporting transactions. Before entering a rebate or charge in Autopoll, it is necessary to clarify which type of rebate/charge shall be used. Details further down below.

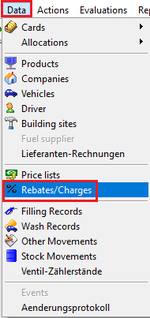

Menu call up

The rebates and charges management can be opened via Data-Rebates/Charges in the menu or by using the icon ![]()

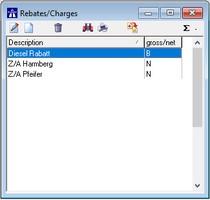

List of rebates/charges groups

The meaning of each icon ![]() is being explained under general handling.

is being explained under general handling.

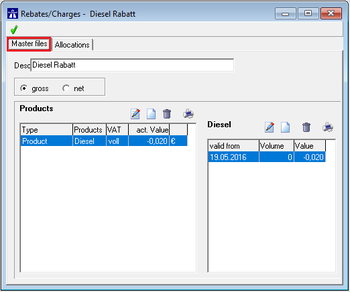

Management of rebates/charges groups

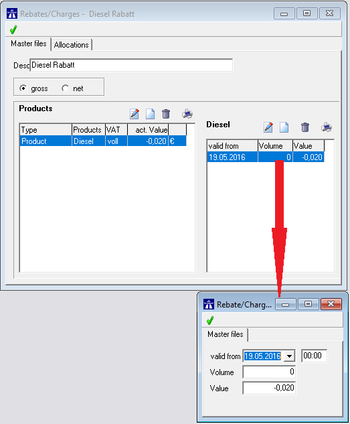

Master data

Desc.: unique name of the rebate or charge group

Selection net or gross rebate/charge

left area "Products": List of all included rebates/charges in the actual rebate/charge group with the acutal rebate/charge values

right area Rebate/Charge values: List of all the rebate/charge values (histroy) of the rebate/charge selected on the left side

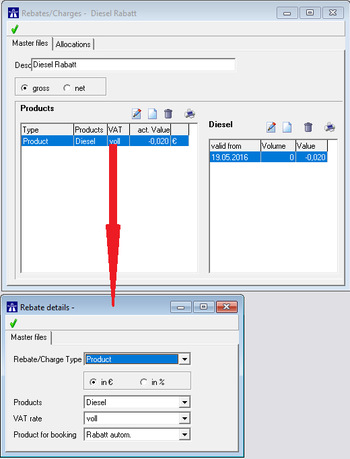

Left area: management of rebate/charge types

Rebate/Charge Type: the following selections are available:

Fuels: all products assigned to the product type "Fuels" (see Products) are affected by the rebate/charge.

Oils: all products assigned to the product type "Oils" (see Products) are affected by the rebate/charge.

Wash: all products assigned to the product type "Wash" (see Products) are affected by the rebate/charge.

Product: only one selectable product is affected by the rebate/charge.

Total: all products are affected by the rebate/charge.

The above mentioned rebate/charge types are only calculated and stated in the invoicing process. An active rebate/charge of one of these types will be calculated according to the configured values and afertwards printed on the invoice as a separate row at the bottom.

per Fill: only one selectable product is affected by the rebate/charge.

In difference to the above mentioned rebate/charge types, using this type ("per Fill") activates a direct calculation of the rebate/charge in the filling price and therefore in the filling amount. That means that no invoicing is needed and in all reports and lists the values (price and amount) include the rebate/charge.

in € or in %: selection whether the rebate/charge is an amount or a percentage rate

Products: only active, when the rebate/charge type "Product" or "per Fill" was selected. Selection of the product which shall be affected by the rebate/charge. Selectable are all products entered in Products.

VAT rate: Selection of the VAT rate which shall be used. Selectable are all VAT rates entered in VAT.

Product for booking: only active when rebate/charge type "Fuels", "Oils", "Wash", "Product" or "Total" was selected. Selection of the prdouct which shall be printed on the invoice. Selectable are all products entered in Products.

Right area: management rebate/charge values

Valid from: start date and time of the rebate/charge validity

Volume: in case of a quantity rebate/charge the quantity from which the rebate/charge is valid

Value: charge value = positive value, rebate value = negative value

In case of the previous selection "in %": value = percentage rate

In case of the previous selection "in €": value = full currency amount (e.x. 2 Euro-Cent charge = 0,02)

![]() Do not delete or edit any rebate/charge values. Otherwise the prices and amounts being calculated incorrectly during retroactive assignments of fillings or calculations (e.x. during invoicing). In addition you will loose the history of your rebate/charge values.

Do not delete or edit any rebate/charge values. Otherwise the prices and amounts being calculated incorrectly during retroactive assignments of fillings or calculations (e.x. during invoicing). In addition you will loose the history of your rebate/charge values.

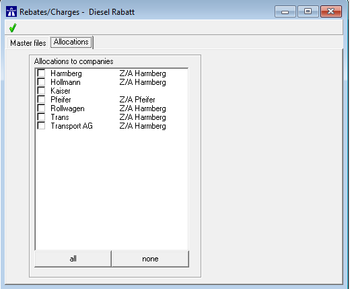

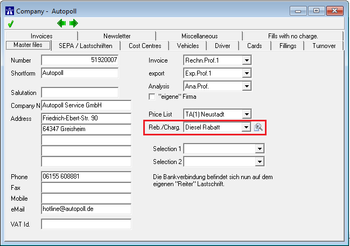

Assignment

The assignment of rebates/charges to a company can be done over the register "Allocation" in rebates/charges or over the field "Reb./Carg." in the corresponding company.

via rebates/charges

via the company

Hints

- It is recommended, that all pricelists, rebate/charge groups and invoicing profiles are kept all' only in Net or all only in Gross. If Net-Gross-mixed lists, groups and profiles are being used, the possibility of rounding differences during calculations, e.x. filling lists or incoices, is pretty high. See Gross Net